The 2021 Federal Budget harks back to the immediate post GFC budgets in some ways, with the Treasurer resisting any temptation to start early on the task of budget repair and doubling down on stimulus. The government has announced $96 billion of extra spending over the next four years, but the run of deficits will still be lower than was predicted last October, making this a bit of a “have your cake and eat it too” budget. Enabling this largesse is an anticipated $104 billion revenue windfall, thanks largely to a stronger than expected economic rebound and strength in commodity exports over the past year.

That said, projected deficits over the forward estimates haven’t changed much, meaning that the government has allocated away most of the improved revenue position for coming years (although they’re operating under pretty conservative assumptions, particularly in relation to iron ore prices). It is very clear that at least in the short term, the emphasis will be gradual budget repair through growth rather than austerity. We’re all Keynesians now, although it hasn’t been lost on many observers that some of those cheering on this budget were arguing for fiscal restraint in the years after the GFC.

Within this framework, the budget has a number of immediate objectives: to provide continued support for the recovery on the road to full employment, higher wages and improved living standards; to boost participation and productivity and help the economy grow faster; and to address specific challenges in areas such as aged care, and women’s economic security. There were also significant announcements in infrastructure – including $2 billion in funding for ambitious tunnelling projects under the Blue Mountains – more help for home buyers and an extension of the instant asset write-off for businesses. There are lots of winners from a budget like this, sending a strong signal about the possibility of an election within the next year if the vaccine rollout improves and the government manages to avoid further scandals. On the losing side are future taxpayers and recipients of Australian foreign aid, which was cut for this year and across the forward estimates.

What the budget says about the economy

Federal Budgets are always an interesting look at the state of the economy from Treasury’s perspective. This year, they’ve upgraded their growth forecasts, indicating that economic activity is returning to a “new normal” faster than predicted. This certainly matches the lived experience around the streets of our cities, and most sectors outside of tourism and education are probably approaching business as usual. Borders remain closed, but from a purely economic perspective this isn’t as much of an impediment as one might think, given that before the pandemic Australia was a net importer of tourism i.e. our tourists spent more overseas than international tourists spent here.

We think the government’s growth forecasts are a little conservative, and there would seem to be more room for a surprise here on the upside than the downside. The same could probably be said for their unemployment forecasts which now have us heading for 4.5% unemployment by 2023-24, which is an improvement of more than 1% on expectations of late last year.

The outlook from here

Barring another outbreak we appear to be through the riskiest period of the recovery, which spanned the winding back of the large direct fiscal stimulus programs that occurred in stages at the end of September and December 2020, and at the end of March 2021; and the transition to private investment and more indirect forms of stimulus. Although spending promises to be much lower going forward than through this financial year, there is still a step change in the ratio of expenditure to income compared to pre-COVID levels, and given that the government has signalled that they won’t take tax as a proportion of GDP beyond 23.9% some of the future work to balance the budget will likely come in the form of spending cuts.

There’s not much of a hurry on this front – Australia is still well placed in terms of public debt in relation to our international peers The interest rate on debt looks likely to remain lower than forecast nominal GDP growth, meaning that current debt levels are eminently sustainable, and the government has made the right call in not contemplating the kind of austerity programs that followed the GFC across a number of developed economies. The only real risks are the prospect of interest rates and bond yields rising dramatically, but for the moment that’s still a way off.

What are the takeaways for markets?

The amount of stimulus in this budget is likely to contribute to some extent to pressure on the RBA to raise rates earlier than anticipated, but that’s still not likely before 2023, and even after a rate hike or two we’re still likely to remain in what will historically be a very low-rate environment.

From that perspective, there aren’t a lot of implications for long-term bond markets, which aren’t offering much in the way of returns at the moment anyway. Equities might be a different story, given share market affinity for stimulus, but the budget probably serves to reinforce current dynamics, rather than changing the narrative, and given the strong run we’ve had there is a risk of a correction in the coming months albeit against the backdrop of a still rising trend.

Residential property was a key focus for the budget, with measures to lower barriers to entry for new homeowners. In the absence of supply-side reform past experience shows that these initiatives can simply inflate prices further, but it was encouraging to see the extension of the downsizer scheme as part of this package.

Finally, the stimulus is likely to help drive the Australian dollar higher over time, but probably pales in comparison to the influence that high commodity prices and a falling US dollar are having on our currency at this point in time.

Dr Shane Oliver, Head of Investment Strategy & Chief Economist

17th May 2021

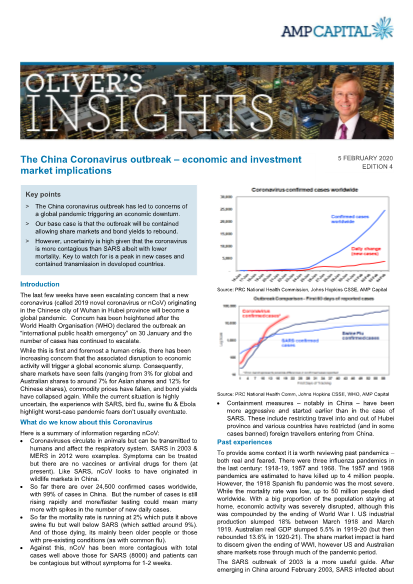

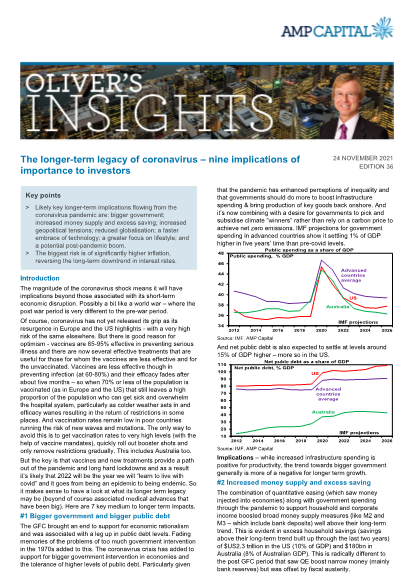

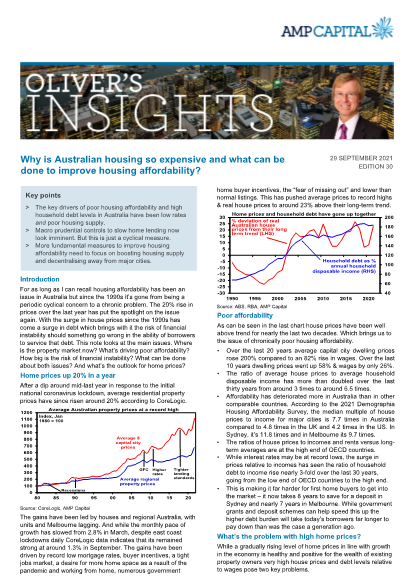

Recent articlesAustralian shares have had a strong start to 2026 with the ASX 200 up 3.3% and flirting with a new record high. The local market has also outperformed US shares which are down 0.1% and global shares which are up 1.6%. However, this could just be noise and follows a significant underperformance against US and global shares since 2009.Share markets have had a bit of a wobbly start to the year, particularly in the US. This note looks at nine key charts worth watching.Much in economics is shades of grey and so subject to some debate. This has certainly been the case around the rebound in inflation in Australia, the RBA’s response and what’s driving it. This note looks at the key issues.The RBA’s decision to hike rates to 3.85% was no surprise with it being about 70% factored in by the money market and 22 of the 28 economists surveyed by Bloomberg expecting a hike.As Winston Churchill is said to have said “if you put two economists in a room, you get two opinions...” Or “if you laid all the economists in the world end to end, they’d never reach a conclusion” as often attributed to George Bernard Shaw.Despite uncertainty around US President Trump’s policies, geopolitics and interest rates, 2025 saw strong investment returns on the back of falling interest rates, solid economic and profit growth globally and expectations for stronger profit growth in Australia. AI enthusiasm boosted US shares although they were relative underperformers globally.2025 initially saw turmoil as US President Trump announced tariffs that were much higher than expected along with a bunch of other moves to upend US institutions and the global economic order. But the global economy held up okay.The RBA’s decision to leave rates on hold at 3.6% was no surprise with it being the consensus amongst all 29 economists surveyed by Bloomberg and the money market factoring in zero chance of a change.National average property prices rose solidly again in November with this year’s rate cuts boosting demand along with the expanded 5% first home buyer deposit scheme. All capital cities saw prices rise.For as long as I have been an economist, housing affordability has been an issue. But while it was once mainly a cyclical concern associated with bouts of high interest rates, from the 2000s it’s become a chronic problem.With national home prices at new record highs housing affordability has reached a new record low.November has been volatile, with U.S. shares down 3.2% and Australian shares off 5% from October highs. Concerns about an AI-driven bubble have grown, as experts warn valuations may be stretched, prompting investor caution.Whether it be the cycle of day and night, seasons, tides, the weather, fertility cycles, birth and death, etc, cycles are integral to life. And so too for economies and investment markets. Some are regular, some just rhyme. Despite attempts to end or subdue them via economic policy and regulation they live on.Rich share market valuations are warning of the risk of a pullback in shares amidst fears of a bubble and it’s possible that enthusiasm for AI has run ahead of itself. But the fundamentals behind this are arguably far stronger than they were at the time of the late 1990s tech boom.From the early 1980s investment returns were spectacularly strong. Despite some bumps, like the 1987 crash, this was reflected in Australian balanced growth superannuation funds returning an average 14.1% pa in nominal terms and 9.4% pa after inflation between 1982 and 1999. And that was after taxes and fees.Since the start of last year gold has made a succession of record highs. But what’s driving it? Is it a forewarning of more high inflation, or something more serious? Is gold something investors should have in their portfolios?The Australian economy was stronger than expected in the June quarter, with GDP up 0.6% and by 1.8% over the previous twelve months.If there is “one thing” investors should know about investing, it’s the power of compound interest or returns. In the ever-rising obsession with short-term developments impacting investment markets around the economy, interest rates, profits, politics, etc, it’s often forgotten about.The RBA sees inflation running around target but has revised its growth forecasts down again. Its forecasts assume that the cash rate will continue to “follow a gradual easing path”, implying that without further easing, growth and inflation will be lower and unemployment higher than its forecasting.Former RBA Governor, Philip Lowe noted that boosting Australia’s weak productivity “should be the issue that dominates economic discussion”. At last, this seems to be happening. In the run up to the Federal election there was much discussion about Australia’s falling living standards and poor productivity. And the Government has recognised the issue with the Treasurer to host an “Economic Reform Roundtable” next month. This is good news. But why is productivity a hot topic at present in Australia?The Australian residential property market creates much consternation. On one level there is the debate about the outlook for home prices with some real estate spruikers still wheeling out versions of the old “property will double every seven years” line versus property doomsters at the other extreme saying it’s overvalued and overindebted and so a crash is inevitable.Despite plenty of concern around the property downturn, structural problems and now US tariffs, Chinese economic growth has so far been okay. Compared to the roaring 2000s there is no doubt that Chinese growth has slowed.Seven key charts worth watching are: Trump’s tariffs; business conditions PMIs; long term inflation expectations; inflation; profit growth; the gap between earnings yields and bond yields; and the $US. For now, they are mixed.While recession fears, worries about US tariffs and war with Iran resulted in volatility, 2024-25 saw another financial year of strong returns helped by central bank rate cuts, economic conditions proving better than feared, and as President Trump paused the worst of his tariffs and Iran fears fizzled.Every so often the degree of uncertainty around investment markets surges and that’s been the case this year with President Trump’s tariffs.Conflict regularly flares up in the Middle East leading to concerns of a threat to inflation and economic growth via a surge in oil prices like in the 1970s and early 1980s.We expect further cuts – implications for the economy and investors.Trump’s policy making has led to lots of volatility in shares – with record highs in February then plunging 14 to 19% on the back of tariff worries into and after his Liberation Day “reciprocal tariff” announcement, only to recover around three quarters of their falls.The return of Labor with an increased majority basically means more of the same in terms of key economic policies.Investment markets are driven by more than just fundamentals. Investor psychology plays a huge role and helps explain why asset prices go through periodic booms and busts & why they can react in extreme ways to events.President Trump’s trade war poses a threat to Australian economic growth particularly via the indirect impact of weaker global activity driving less demand for our exports and lower commodity prices.Share markets have fallen further on US President Trump’s worse than expected tariff policies.AMP economists Dr Shane Oliver, Diana Mousina and My Bui explain what impact the 2025-26 Federal Budget could have on the Aussie economy and investment markets.Share markets have fallen sharply in recent weeks as uncertainty around US President Trump’s policies have led to renewed concerns about the risk of recession at a time when share market valuations were stretched.While anticipation of devastation from Cyclone Alfred saw the PM ditch plans to call an election for 12th April, we are effectively in an election campaign with the Government announcing numerous spending promises since January and the Coalition often matching them.Share markets have so far been fairly resilient in the face of uncertainty around Trump’s policies particularly tariffs. However, nervousness is creeping in. This note looks at seven key charts worth watching.Last December the RBA noted that “if the future flow of data continued to evolve in line with or weaker than [RBA] expectations…it would in due course be appropriate to begin relaxing the degree of monetary policy tightness.”Trump has followed through with his threat since last November to impose 25% tariffs on Canada (except energy which is 10%) and Mexico and a 10% tariff on China. This was originally set for a 4th February start.Currency markets are well known to be volatile – as there is no clear agreement on how to value them and they are vulnerable to international shocks and shifts in investor sentiment. Changes in the value of the $A are important as they impact Australia’s export competitiveness and the cost of imports, including that of overseas holidays.2024 saw another year of strong investment returns on the back of falling inflation, global rate cuts and growth and profits better than expected. US shares were particularly boosted by AI related enthusiasm and optimism that President elect Trump will boost the US economy with tax cuts and de-regulation.Falling real wages and a surge in tax and interest payments have led to a slump in Australian living standards. Key policies to boost productivity growth include: tax reform; a cap on public spending as a share of the economy, deregulation; greater incentives to invest; and competition reforms.Key things to keep an eye on in 2025 are: interest rates; recession risk; a potential trade war; and the Australian consumer.Why investors should expect a somewhat rougher ride, but it may not be as bad as feared with Donald Trump's US election victory.Dr Shane Oliver suggests five ways to help manage the noise and stay focussed as an investor with the changes in the macro enviroment.This edition looks at why the concept of value or valuations are important in investing and what they are telling us now - particularly in relation to shares.In the confusing and often seemingly illogical world of investing, investors often make various mistakes that keep them from reaching their financial goals. This note takes a look at the nine most common mistakes.This week's edition looks at China’s pivot from incremental and modest policy stimulus to providing more aggressive support for its economy.The US election has significant potential to impact markets. A Harris victory would mean more of the same, but a Trump victory could lead to uncertainty particularly around trade.Recession risks, the escalating Israel conflict, the US election along with still stretched valuations mean a high risk of another share market correction and continued volatility.Apart from “what will home prices do?" and "where are the best places to buy a property?" the main debate around the Australian housing market has been about poor housing affordability, occasionally interspersed with a scare that home prices will crash.This week we take a look at why shares and other growth assets really are long term investments. In other words, its not just marketing spin to be wheeled out after sharp falls in share markets like we saw two weeks ago.Seven key charts worth watching are: inflation; inflation expectations; global business conditions PMIs; unemployment and underemployment; profit growth; the gap between earnings yields & bond yields; & the $US.Share markets have seen big falls on the back of rising recession fears. For the last two years there has been constant fears of a recession – or a contraction in economic activity – on the back of central bank rate hikes.This article takes a look at the rise of populism and what it means for economic policies and investors.This article looks at the outlook for the Australian share market which has risen to new record highs above the 8000 level for the ASX 200.Changes in the value of the Australian dollar are important as they impact Australia’s international export competitiveness and the cost of imports, including that of going on an overseas holiday.There has been a wall of worry for investors over the last year but as is often the case share markets climbed it. This resulted in another financial year of strong investment returns in 2023-24. But can it continue?Dr Shane Oliver shaes his nine most important lessons from investing over the past 40 years.National average home prices rose another 0.8% in May, pushing them further into record territory.The US presidential election – implications for investors and AustraliaThis year has seen a bit of a rollercoaster ride in interest rates expectations. This article looks at the outlook for the RBA’s cash rate.Read about the economic and investment market implications of the 2024-25 Federal Budget announcements.This article looks at seasonal patterns in shares and whether its time to “sell in May and go away” along the lines of the old share market saying.The obvious issue is how vulnerable are shares? Could the bull market that got under way from the inflation and interest rate lows of 2022 (that has seen global shares rise 42% and Australian shares rise 23%) be over?The Australian housing market has started the year on a solid note with national home prices up 1.6% over the first three months according to CoreLogic. We had thought the drag of high mortgage rates would get the upper hand again but the supply shortfall is continuing to dominate.It’s four years since the COVID lockdowns started. The pandemic ended when it morphed into the less deadly Omicron variant in late 2021, but just as a sound can reverberate around a room the effects of the pandemic continue to reverberate in economies.Bitcoin attracts extreme views - evangelists on the one hand and agnostics and atheists on the other in contrast to other things where the debate is between bulls and bears. This note looks at what it means for investors.Investing can be scary and confusing at times. But the basic principles of successful investing are timeless and quotes from experts help illuminate these.Seven key charts worth keeping an eye on are: global business conditions PMIs; inflation; unemployment and underemployment; inflation expectations; earnings revisions; the gap between earnings yields and bond yields; and the US dollar.Last year shares climbed a “wall of worry” as inflation fell leading to prospects for lower interest rates ahead. But can it continue? After participating in a webinar on the investment outlook this note takes a look at the main questions investors have in a simple Q&A format.The Australian tax system has five key problems: it’s heavily reliant on income tax; it’s complicated by numerous tax concessions; it’s highly progressive; it has ongoing problems with “bracket creep”; & suffers from several anachronisms.The surge in inflation coming out of the pandemic and its subsequent fall has been the dominant driver of investment markets over the last two years – first depressing shares and bonds in 2022 and then enabling them to rebound.Despite lots of angst at the start of the year, 2023 turned out far better than feared. Dr Shane Oliver reflects on key themes from the past year and suggests what investors should look out for in 2024The five key themes for 2023 were: better than feared growth; disinflation; peak interest rates (probably in Australia too); lots of geopolitical threats but not as bad as feared; and AI hit the big time. This boosted shares and helped bonds with solid superannuation fund returns.The decision by the RBA to leave rates on hold at its December meeting and whether we have reached the top or not. At its December meeting the RBA left rates on hold but retained a tightening bias with still relatively hawkish commentary.Five reasons to expect the Australian dollar to rise into next year: it’s undervalued; short term interest rate differentials look likely to shift in favour of Australia; sentiment towards the $A is negative; commodities still look to have entered a new super cycle; and Australia has a solid current account surplus.Successful investing is not always easy and can be stressful. Even in good times. For this reason, it’s useful for investors to keep a key set of things in mind.Australian home prices rose again in October, with the supply shortfall on the back of record immigration dominating. While this is likely to continue, there is a high risk that the impact of high interest rates will start to get the upper hand next year particularly if the RBA hikes again and unemployment rises by more than expected.Five megatrends suggest higher medium term inflation pressures & lower economic growth than pre-pandemic.The war in Israel is terrible from a humanitarian perspective. From an economic and investment perspective the concern is that it will lead to a surge in oil prices that will add to inflation, keep interest rates higher for longer and add to the risk of recession.This edition of Oliver's Insights looks at the impact of rising bond yields on shares, the risks flowing from the renewed conflict in Israel and comparisons to the run up to the 1987 share crash.Starting point valuations – like yields and price to earnings ratios – are key drivers of medium-term investment returns.Dr Shane Oliver discusses the key drivers of poor housing affordability in Australia and particularly the role played by high immigration levels.While the risk in the short term is still on the upside for rates or a delay to the start of rate cuts, our base case is that rates will be on hold until early next year ahead of rate cuts starting in the March quarter.It seems that the worry list for investors has become more threatening and confusing. However, to succeed, it makes sense to err on the side of cautious optimism: otherwise, there is no point in investing; growth assets like shares have trended up over the long term; and trying to get the timing right of the 2 or 3 years out of 10 when they fall can be very hard.This article looks at the current concerns about the Chinese economic outlook and how Australia can't rely on the China/commodity boom indefinitely.This article takes a look at why boosting productivity growth matters and why it might be hard (beyond a return to normal after pandemic related distortions).Recession versus “goldilocks” – five reasons why we could still avoid recessionThis article takes a look at the currently confusing economic landscape with some indicators being very strong and others very weak.Seven key charts worth keeping an eye on remain: global business conditions PMIs; inflation and our Inflation Indicators; unemployment and underemployment; inflation expectations; earnings revisions; the gap between earnings yields and bond yields; and the US dollar.Getting our personal finances right can be a challenge at times. And the surge in interest rates has arguably made it even harder for many. This article looks at some common-sense personal finance tips that may be of use.The past financial year saw a solid rebound in investment returns, after the negative returns of the 2021-22 financial year. This note reviews the past 12 months in investment markets and looks at the outlook.Recession has been a recurring theme over the last year or so but has intensified lately. But what's driving it? How serious is the risk of recession? And what would it mean for Australians and investors?Dr Shane Oliver outlines the large worry list for shares; some positives that still exist; and the implications for investorsThis note looks at the decline in Australia’s home ownership rate since the mid-1960s and what has driven it.Key to watch will be bond yields, whether the economy avoids recession and where “work from home” settles.Dr Shane Oliver and Deputy Chief Economist Diana Mousina explain what effects the Federal Budget could have on the Australian economy and investment markets.Australian home prices rose again in April & along with other indicators suggest the home price downturn is over, but we must now watch rates and unemploymentThis article takes a look at the recommendations of the independent Reivew of the RBA and it’s not clear the proposed reforms will lead to a better outcome for the Australian economy.Five charts focusing on critical aspects of investing that are insightful in times of market stressDr Shane Oliver looks at the outlook for Australian property prices, particuarly given the bounce in prices over the last month or so.US banks, inflation, interest rates and recession risk - what it means for investors?Seven key charts for investors to keep an eye on are: global business conditions PMIs; inflation; unemployment & underemployment; longer term inflatione expectations; gap between earnings & bond yields; & the US dollarThe RBA hiked again by 0.25% taking the cash rate to 3.35%. It continues to expect to increase interest rates further.Dr Shane Oliver explains seven reasons why Australian shares are likely to outperform global shares over the medium term2022 was dominated by high inflation, rising interest rates, war in Ukraine & recession fears. This hit bonds & shares hard, driving losses for balanced growth super funds.The article reviews the key developments of 2022 of relevance for investors and their impact on investment markets, and takes a look at the outlook for 2023.The home price slump continued in November, with still more to goThe surge in inflation should start to reverse next yearAt last, it seems some of the bad news for shares appears to be abating. It’s certainly been a rough year.Economic and financial commentary has been particularly gloomy of late, with talk of a “dire”, “grim”, “bleak”, “perilous” and “confronting” outlook.The Government has implemented its election policies and expects lower budget deficits this year and next thanks to another revenue windfall and various savings.Successful investing can be really hard in times like the present. Falls in share markets and other assets are stressful as no one likesto see their wealth decline and the natural inclination is to retreat to safety.The latest client note by Howard Marks, the co-founder and co-chair of Oaktree Capital, an alternative investment manager focussing on distressed debt, on The Illusion of Knowledge about the futility of forecasting to drive investment decisions, inspired me to revisit what I had already written on this subject.The RBA has increased its cash rate again but slowed the pace to +0.25% which took the cash rate to 2.6%....Investors could be forgiven for looking back on the pandemic years of 2020 and 2021 with fond memories – because after the initial shock in February-March 2020 it was a period of strong returns and relative calm in investment markets.The last twenty years have seen a sharp slowdown in productivity growth in AustraliaShares remain vulnerable in the short term. They had a nice rebound from ..“This time is different” have been described as the four most dangerous words in investing by Sir John Templeton. But there is good reason to believe this Australian home price downturn cycle will be different...Booms, busts and investor psychology – why investors need to be aware of the psychology of investing

Investment markets are driven by more than just fundamentals. Investor psychology plays a huge role and helps explain why asset prices go through periodic booms and busts...Cycles are part of life. Whether it be the cycle of day and night, seasons, tides, weather cycles from the almost weekly cycles of cold fronts that regularly blow across southeast Australia...As widely expected, the RBA has increased the cash rate again by 0.5% taking it to 1.85%.The start of this year has been painful for investors with sharp losses in shares and bonds, dragging most superannuation funds into negative returns for the last financial year...I grew up in the 1970s and it was fun – Abba, Elvis, Wings, JPY, flares, cool cars, etc. But economically it was a mess.The past financial year was poor for investors as inflation, rising interest rates and recession fears hit investment markets.Australian household debt has risen dramatically since the 1980s and is high compared to other countries.Share markets have fallen sharply in recent weeks continuing the plunge that started early this year due to worries about inflation, monetary tightening, recession & geopolitical issues including the invasion of Ukraine.The RBA has hiked the cash rate again - by 0.5% taking it to 0.85% and continues to signal more rate hikes ahead.Australian home prices fell 0.1% in May, their first decline since the pandemic.The ALP won the election and is set to Govern most likely in its in own right or as a minority government.Last year saw very strong investment returns and was relatively calm in investment markets.Another five great charts on investing that are very useful in times of uncertainty like the present

Successful investing can be really difficult in times of uncertainty like now making it important to stay.For the first time since November 2010, the RBA has raised its official cash rate - from 0.1% taking it to 0.35%.Accessing green energy isn’t only for the wealthy. Companies like Evergen are making it more affordable for everyone. We talk to Ben Hutt, CEO & Managing Director for Evergen and Bopha Ly, Managing Director, Energy for AMP Capital’s Infrastructure Equity business to get their perspective.As inflation returns to the global economy, can holding infrastructure assets protect a portfolio from rising prices? We explore.The very strong employment market is putting pressure on the Reserve Bank to lift interest rates. Our Senior Economist dives deeper.Australian election campaigns tend to result in a period of uncertainty which have seen weak gains on average for shares followed by a bounce once it’s out of the way.National average property prices are likely to peak around mid-year and then enter a cyclical downswing. After 22% growth in national average home prices last year, average home price growth this year is expected to be around 1% and we expect a 5-10% decline in average prices in 2023.Five great charts on investing that are particularly useful in times of uncertainty like the present

Investing is often seen as complicated. This has been made worse over the years by: the increasing complexity in terms of investment products and choices; regulations and rules around investing; the role of the information revolution and social media in amplifying the noise around investment markets...The Budget delivered no surprises when it came to super. There were two measures which had a direct impact and each of them had been released previously, one only in the past few days. Graeme Colley explains further.In this short video, AMP Senior Economist Diana Mousina gives a round-up of the key outcomes from last night’s 2022-23 Federal Budget proposals and explains what effect they could have on the Australian economy.The 2022-23 Budget supports investment in premium real estate assets with high-quality leasing covenants that can deliver optimal income returns through a period of volatility driven by higher interest rates.The 2022-23 Budget provides a “magic election pudding” of more spending but lower deficits. The additional spending relates mainly to this calendar year and given the strong economy is more motivated by politics than economics.After much anticipation, the US Federal Reserve has raised its Federal Funds target interest rate from a range of 0-0.25%, where it’s been for the last two years since the pandemic started, to the range of 0.25-0.5%.World oil prices have spiked to their highest levels since 2008, rising more than 30% since the war in Ukraine started.Humans do horrible things to each other, and war is the worst example of that. What was first announced by Russia earlier last week as a “peacekeeping” force ...While the extent of the local and global economic recovery post COVID-19 is unclear, there are still opportunities for investors able to capitalise on key trends that we believe will drive the performance of commercial real estate in 2022.What happens to interest rates is always important for investors, but particularly so at turning points in the economy. Our Senior Economist discusses why.Despite the rough and uncertain start to the year there is reason to be optimistic about the share market in 2022.The last few days have seen a sharp escalation in the situation between Russia and Ukraine, with Russia recognising the independence of two regions in the Donbas areaThis note covers the main questions investors commonly have regarding the investment outlook in a simple Q&A format.While shares have had a nice rebound from their January lows helped in part by some good earnings news – reversing around half of their 10% or so fall, ...Over the last six months several central banks have raised interest rates. This started in emerging markets but developed country central banks have also hiked rates...Share markets have fallen in recent weeks on the back of worries about inflation, monetary tightening, the Omicron disruption and the rising risk of a Russian invasion of Ukraine.For last few decades inflation has not been much of an issue. It was all about economic activity. Books were even written about “the death of inflation”.Despite a wall of worry with coronavirus and inflation, 2021 was a great year for diversified investors,Just as 2020 was dominated by coronavirus so too was 2021. But 2021 turned out to be a far better year for investors. The big negatives of 2021 were of course dominated by coronavirus...As far as real estate sectors go, retail has been the most challenged globally over the past 24 months. But for investors who are ready to look beyond the challenges, we take a look at why it's still an exciting investment and development propositionWith the global economy rapidly launching back into recovery mode and prices on the rise, real assets are uniquely positioned to help investors ride out the current inflationary surge.In our special outlook for 2022, we look at the tough choices investors face as global economic growth picks up.Australian home prices have boomed this year. They are up 22.2% over the 12 months to November according to CoreLogic with Hobart (+28%), Sydney (+26%), Brisbane (+25%), Canberra (+25%) and regional prices (+25%) leading the charge.The magnitude of the coronavirus shock means it will have implications beyond those associated with its short-term economic disruption.A retirement portfolio’s allocation of growth and defensive assets traditionally depends on an investors’ risk profile.Post-COVID, what does the road to recovery for infrastructure look like? And what role does infrastructure play in a portfolio?Australia’s net zero debate could leave the impression that climate change is all about heavy manufacturing, regional towns and coal-fired power stations.If there is one “technical thing” investors should know about investing, it’s the power of compound interest.The march of central banks towards tighter monetary policy has stepped up over the last few months.It’s normal for bond yields to rise in economic recoveries but it’s looking increasingly likely that the nearly 40-yearScience and medicine appear to be getting the upper hand of coronavirus - implications for investors

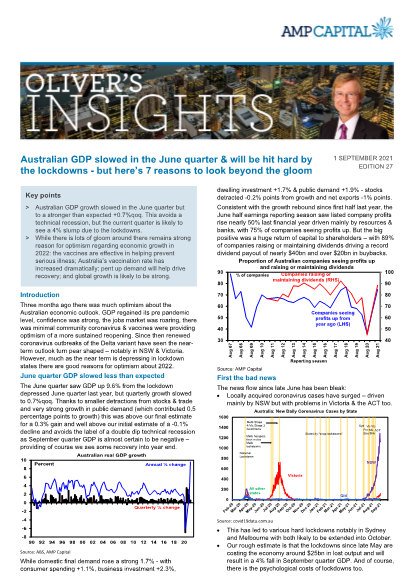

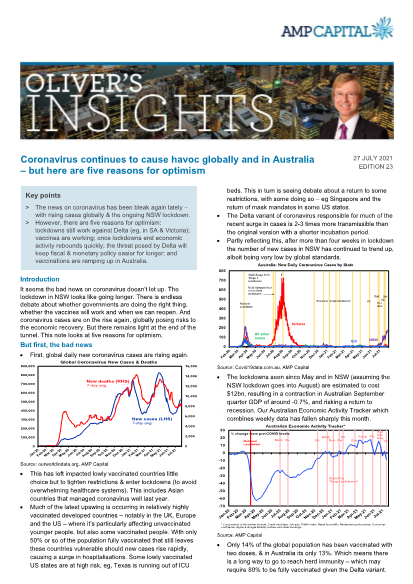

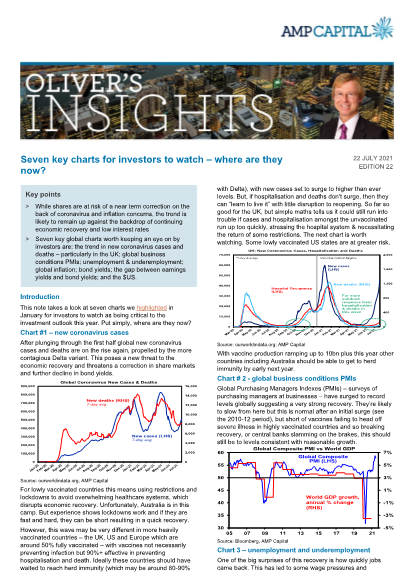

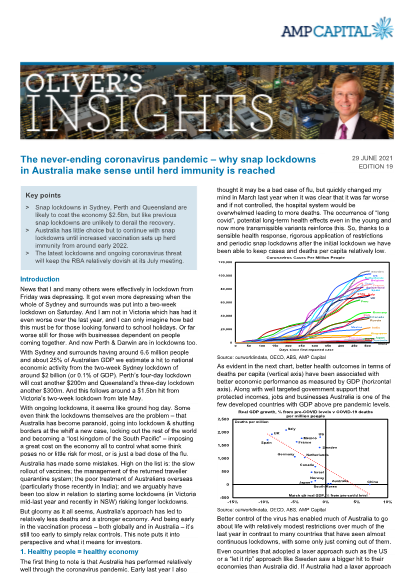

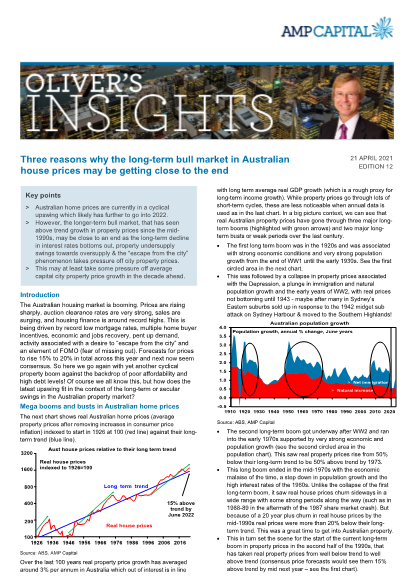

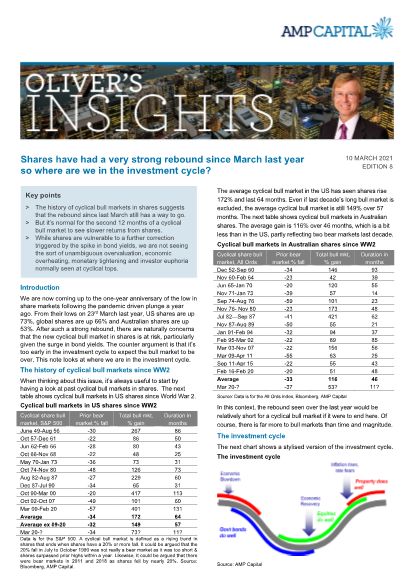

There are increasing signs that science and medicine are getting the upper hand against coronavirus: new global cases are in decline;For as long as I can recall housing affordability has been an issue in Australia but since the 1990s it’s gone from being a periodic cyclical concern to a chronic problem.Australian GDP slowed in the June quarter & will be hit hard by the lockdowns - but here’s 7 reasons to look beyond the gloomAfter surging 65% from its coronavirus low in March 2020 to its high in February this year, the Chinese share market saw an 18% decline into July.Despite lots of worries – around the resurgence of coronavirus driven by the Delta variant, peak growth, peak monetary and fiscal stimulus and high inflationThe current environment seems to be one of extreme uncertainty. We have seen a strong economic recovery from last year’s global and Australian recessionsIt seems the bad news on coronavirus doesn’t let up. The lockdown in NSW looks like going longer.In January for investors to watch as being critical to the investment outlook this year. Put simply, where are they now?Five ways to turn down the noise and stay focused as an investorThe past financial year saw a spectacular rebound in returns for investors as the focus shifted from the recession to recovery against a backdrop of policy stimulus and vaccines. This note reviews the last financial year and takes a look at the outlook.News that I and many others were effectively in lockdown from Friday was depressing. It got even more depressing when the whole of Sydney and surrounds was put into a two-week lockdown on Saturday.The drumbeat of central banks heading towards the exits from ultra-easy monetary policy is getting louderThe shift from high inflation to low inflation has been a key tailwind for investment returns over the last 40 years – in particular it has allowed capital growth in excess of growth in earnings and rentsThe Australian economic recovery remained strong in the March quarter with GDP up 1.8% – seven reasons for optimismInflation will likely rise further in the months ahead due to base effects, bottlenecks & reopening but it’s likely to fall back again from later this year as these drivers fade.The 2021 Federal Budget harks back to the immediate post GFC budgets in some ways, with the Treasurer resisting any temptation to start early on the task of budget repair and doubling down on stimulus.The Government now expects the Federal budget deficit to peak at $161bn this financial year (down from $214bn in October’s Budget) and fall to $107bn in 2021-22.Geopolitical risks are higher than prior to the GFC reflecting three big themes: a populist backlash against economic rationalist policies; the falling relative power of the US; and the polarising impact of social media.The Australian housing market is booming. Prices are rising sharply, auction clearance rates are very strong, sales are surging, and housing finance is around record highs.It makes sense that the cheaper you buy an asset the higher its prospective return will be. However, this is frequently forgotten with investors often tempted to project recent returns into the future regardless of valuations.Articles and updates. A new age of infrastructure energy and investment is dawning Preparing for the post-COVID recovery in real estate, the bonds market and more...Global recovery is on track. Vaccines are working. JobKeeper’s end won’t derail Australia’s recovery. Inflation could become an issue in the medium term. Shares are at risk of a correction but are supported by economic and earnings recovery.RBA on hold and likely to remain easy for a long while yet as full employment gets more of a look in. While the economy is recovering faster than expected. The RBA will likely start to slow its quantitative easing measures through this year though.The history of cyclical bull markets in shares suggests that the rebound since last March still has a way to go.Digital currencies and blockchain technology may have a lot to offer - but that does not mean Bitcoin will be it.The 40-year downtrend in inflation and bond yields is likely over. But the fundamental backdrop of improving growth, rising profits and still low rates supports the case for solid 6-12 month returns from sharesExpect average Australian home prices to rise 5-10% this year and next as ultra-low interest rates and economic recovery feed through. However, the outlook is divergent...The super rules change regularly, and this year is no exception.Many of the mistakes investors make are based on common sense rules of thumb that turn out to be wrong.Will Airports ever be the same, Real estate rock stars, USA Game changing year and the face of front line respondersShares are at risk of a short-term correction or consolidation, but investment markets should provide solid returns this year on the back of continuing economic recovery and low interest rates.Our high-level investment view is that while shares are vulnerable to a short term correction having run up hard since early November, overall investment returns will be solid this year on the back of economic recovery (driven by stimulus and the deployment of vaccines allowing a more sustained reopening) at the same time that interest rates remain low.US protests are only an issue for investment markets if they significantly impact economic activity2020 turned out far better for investors than was feared. 2021 is expected to provide solid returns & see a further rotation from pandemic winners to cyclical investments.Review of 2020, not what it was supposed to be - Outlook for 2021 - RecoveryFor some years now Modern Monetary Theory (MMT) has been gaining prominence as a solution to the perceived failure of traditional economic policies to achieve full employment & meet inflation targets, despite at or near zero interest rates.The US election has been close and final counting as well as legal challenges could still upset the result, but the now highly likely outcome is a Biden Presidency.The RBA has cut the cash rate to a record low 0.1% & announced a broad-based quantitative easing program.Despite a 35% or so plunge in share markets earlier this year; on the back of the pandemic and rough patches in 2018, 2015 and 2011, well diversified Australian investors have seen pretty good returns over the last 10 years. The median balanced growth superannuation fund returned 5.8% pa over the five years to August and 7.3% pa over 10 years and that’s after fees and taxes. While that’s dull compared to the double digit returns of the higher inflation world of the 1980s and 1990s, it’s pretty good once low inflation of 2% pa or less is allowed for.The 2020-21 Australian Budget – spend, spend, spend as the focus remains on recovery and jobs, jobs, jobsAustralia’s “eye popping” budget deficit and public debt blow out – can it be paid off? Does it matter?In its September board meeting, we saw another move out of the RBA to support the Australian economy through COVID-19, and there could be more to come.RBA holds – but more stimulus likely as Victorian lockdown to knock at least $12bn from national GDP

Victoria’s tightening lockdown could knock at least $12bn off the Victorian and national economy and delay the return to positive Australian GDP growth to the December quarter.The thought of various government support measures expiring in the months ahead, causing some sort of fiscal cliff over which economies and share markets will plunge, has caused much consternation. But as with the original fiscal cliff of December 31, 2012 in the US, it’s likely to be tapered into a fiscal slope.The past financial year was poor for investors as coronavirus knocked economies into what is likely to be their biggest hit since the 1930s. Shares were hit hard, but the blow was softened by a strong rebound in the June quarter. This note reviews the last financial year and takes a look at the outlook.A serious second wave of coronavirus cases in major developed countries is the biggest risk facing equity markets, and one investors will need to watch closely.The strong rally in shares since their March lows reflects a combination of economic reopening, signs of recovery, policy stimulus and once pessimistic investors closing underweight or short positions.Australian house prices starting to fall – collapse likely averted but expect more weakness aheadThere has been much debate about the short-term economic and investment impact of coronavirus – on economic activity, unemployment, interest rates, house prices, shares, etc.Back in January when the bushfires were raging, I feared Australia’s luck had ran out. But right now, I thank god I live in The Lucky Country!This is an update of a note I wrote last November, but after the recent plunge in shares and the associated 10% or so loss in balanced growth superannuation funds through the March quarter, it’s particularly relevant now.After a strong rally, in the short-term shares are vulnerable to bleak economic and earnings news.Central bank support to ensure the flow of money and credit through economies is an essential part of the global and Australian coronavirus economic rescueWhile shares have rallied 15-20% from their March low and may have started a bottoming processSignificant government support is essential to enable parts of the economy to successfully hibernateGlobal share markets have fallen into a bear market, but whether this turns out to be long or short depends on how long the hit to the economy from coronavirus lasts.The Australian housing market is at risk from the coronavirus recession Australia has now entered. A relatively short recession that sees unemployment rise to around 7.5% would likely only set prices back around 5% or so after which prices would bounce back.Successful investing can be really difficult in times like the present with immense uncertainty around the impact of coronavirus on the outlook.The rout in financial markets has continued, on the back of coronavirus, made worse by a flow on to oil markets.The plunge in share markets over the last week has generated much coverage and consternation.While reported new coronavirus cases in China have slowed, the pickup in cases outside China has led to a renewed sharp fall in share markets and bond yields.Shares are vulnerable to a short-term correction - Key things to watch out for are recession and much higher inflation.From bushfires to coronavirus - five ways to turn down the noise around investingThe China coronavirus outbreak has led to concerns of a global pandemic triggering an economic downturn. Our base case is that the outbreak will be contained allowing share markets and bond yields to rebound. However, uncertainty is high given that the coronavirus is more contagious than SARS albeit with lower mortality. Key to watch for is a peak in new cases and contained transmission in developed countries.Shares are at risk of a short-term correction or consolidation after a strong run over the last year and with sentiment now very bullish. However, this year should still see good returns for investors as global growth edges up and interest rates remain low. > Five key global charts to watch are: global business conditions PMIs; global inflation; the US yield curve; the US dollar; and global trade growth. > So far so good, with PMIs improving a bit, inflation remaining low, the yield curve steepening, the $US showing signs of topping and the US/China trade truce auguring well for some pick up in world trade growth.The Australian bushfire season that began in September has been horrific with more than 7 million hectares of bush destroyed, more than 25 deaths, significant loss of livestock, estimates of more than a billion wildlife animals killed and more than 1800 homes destroyed. More than 200 fires are still burning. Following the intensification of the bushfires over the Christmas/New Year period attention has now turned to the impact on the economy. This note looks at the key impacts.Even if you secured a competitive package when you first took out your home loan, it’s worth reviewing each year1 to ensure the interest rates, fees and features continue to meet your needs. By refinancing you may be able to pay off your home loan sooner.In this month’s issue we discuss how: James Maydew believes that having culture and strategy on the same blueprint is an absolute imperative climate change is impacting the real estate sector, and how leaders and businesses are standing up to the task of tackling it Julie-Anne Mizzi uses her innate passion for investing in infrastructure for those who need it, and the familiar airport retail experience is set for a makeover.2019 saw growth slow, recession fears increase and the US trade wars ramp up, but solid investment returns as monetary policy eased, bond yields fell and demand for unlisted assets remained strong. 2020 is likely to see global growth pick up with monetary policy remaining easy. Expect the RBA to cut the cash rate to 0.25% and to undertake quantitative easing. Against this backdrop, share markets are likely to see reasonable but more constrained & volatile returns, and bond yields are likely to back up resulting in good but more modest returns from a diversified mix of assets. The main things to keep an eye on are: the trade wars; the US election; global growth; Chinese growth; and fiscal versus monetary stimulus in Australia.

Booms, busts and investor psychology – why investors need to be aware of the psychology of investing

Another five great charts on investing that are very useful in times of uncertainty like the present

Five great charts on investing that are particularly useful in times of uncertainty like the present

Science and medicine appear to be getting the upper hand of coronavirus - implications for investors

RBA holds – but more stimulus likely as Victorian lockdown to knock at least $12bn from national GDP

.jpg)