Dollar Wise Financial Services compare hundreds of home loans to find you the right home loan for your needs. Whether you’re in the market for your first home or building a portfolio of investment properties, Dollarwise Financial Services have access to hundreds of loans from a wide variety of lenders.

We will do all the research for you on seeking products available in the market, and then support you through the application and settlement process making sure all the right questions are asked.

Dollar Wise Financial Services can help you with the following Mortgage Broking Services:

- Home Loans

- Refinancing

- First Home Buyers

- Debt Consolidation

- Investment Property Loans

- SMSF Borrowing

Home Loans

Compare Home Loans to find a Great Deal

There are hundreds of loans available, with new products emerging all the time. Dollar Wise Financial Services offers a free, inclusive mortgage broking service to compare hundreds of loans and find a great deal that suits your needs.

Whether you’re looking for a simple package, or want a tailored loan with extra features, we’ll help you find it and also explain the different types of features available that may benefit you.

Here’s a list of the main types of home loans available:

- Variable

- Fixed

- Split Rate Loans

- Interest Only

- Line of Credit

- Construction

- Introductory/Honeymoon

- Low Docs

To work out which home loan works for your situation please call (03) 9763 0011 for a FREE Home Loan check or visit our contact us page, complete the enquiry form and we will call you.

Backed by Australian Finance Group (AFG)

Established in 1994 as an aggregator – that is, a company which provides mortgage brokers with access to products and support – AFG is now one of the largest providers of mortgage broking services in the country.

AFG is the name behind over 2,000 mortgage brokers Australia-wide. And as the country’s largest broking services company, our brokers have access to around 1,350 products from 31 lenders and have the freedom to choose which products are the right fit for their clients.

With more than 2,000 members nationally, AFG focuses on supporting motivated, high level performers: 30% of Australia’s top 100 mortgage brokers are AFG members. Through our member network, AFG processes around $4 billion of mortgage finance every month, and manages more than $90 billion in mortgage finance.

Mortgage & Financial Association of Australia (MFAA) Approved Broker

The Mortgage & Finance Association of Australia (MFAA) is the peak national body providing service and representation to over 10,000 professional credit advisers (mortgage and finance brokers, mortgage managers and aggregators) to assist them to develop, foster, and promote the mortgage and finance industry in Australia.

Adrian Pearce from Dollar Wise Financial Services are Approved Mortgage Brokers with the MFAA.

Refinancing

Refinancing your home loan is when you either take out a new home loan with a new lender, or negotiate a better loan with your existing financial institution. Refinancing lets you change your home loan to suit your new circumstances.

Looking to refinance your existing loan? Not sure if it will cost you to change banks or if you current home loan is a great deal? Confused with all the paperwork or have some unanswered questions? Speak to Dollar Wise Financial Services about your options. We don’t charge for our mortgage broking service as the lender/bank pay us a commission when you receive your home loan.

We will make the process:

- Easy – we will do all the hard work for you

- Free – we don’t charge you for our mortgage broking service

- Quick – our software can compare hundreds of loans in minutes

- Personal – we will alter the loan to your situations and objectives

- Professional – you will only need to deal with us and not the banks

To work out which home loan work’s for your situation please call (03) 9763 0011 for a FREE Home Loan check or visit our contact us page, complete the enquiry form and we will call you.

First Home Buyers

Australia enjoys one of the greatest home ownership rates in the world. But in a time of high house prices how do you make this great Aussie dream a reality. Buying your first home is an exciting, but big step to take and one that comes with many questions and decisions. The first big question is how much you can borrow ?

Dollar Wise Financial Services are here to help. We do all the groundwork for you. We can compare home loans across the major banks and other Australian leading lending institutions.

Being a first home buyer, you may be eligible for a first home buyer grant. This is a grant available to Australian residents or permanent residents who wish to buy or build their first home, which will be their principal place of residence within 12 months of settlement.

As grant conditions vary from state to state, contact us to find out how much grant money you could receive.

Explaining the Loan Process

Get in touch

It costs nothing to speak to your friendly and qualified mortgage broker at Dollar Wise Financial Services, who can quickly help find out how much you can borrow, which loan may suit your needs, and answer any questions about the process.

Arrange a pre-approved loan

If you haven’t started your property search, or are still looking, a pre-approved loan can be valuable. It gives you a clear picture of what you’re spending limits are and gives you peace of mind. If you find a property you really interested in you can move quickly to make an offer and could potentially put you in a stronger negotiating position than other potential buyers who don’t have pre-approval. Dollar Wise Financial Services can take care of the paperwork to lodge a loan application.

Find your property

Make sure you do plenty of homework when you’re on the hunt for a new property. Research property prices in the area, potential capital growth and existing and planned infrastructure, such as roads, public transport, schools and shops. If you’re unfamiliar with property values in the area, consider a full valuation carried out by a registered valuer before making a final decision.

Make an offer and sign a Contract of Sale

Whether you buy property at auction or make an offer on a listing, your agreement with the vendor only becomes a legal commitment when a Contract of Sale (Offer of Acceptance in WA) has been signed by both parties. This contract will confirm the selling price as well as any terms and conditions. Your commitment will usually be subject to lender approval, a building inspection report and a pest inspection.

The period from signing a Contract of Sale to Settlement – when the property becomes legally yours – is usually six weeks (shorter in some states, such as Queensland). Note: even if you have a pre-approved loan, your lender will still need to complete a valuation of the property you have chosen before issuing full approval.

Pay a Deposit

A deposit is required once a Contract of Sale has been signed by both parties (sometimes called ‘exchanging contracts.’) You won’t yet have access to your home loan, so your deposit will need to come from savings or elsewhere.

Appoint a Conveyancer

You will need a solicitor or conveyancer to check the legalities of the Contract of Sale. Your conveyancer will also check all rates and taxes have been paid, check land use or building approvals for the property and order any relevant searches. They may also help sort out any inspections.

On settlement day, the conveyancer will check the correct amount of money has been transferred from your lender to the seller and all fees – such as Stamp Duty – are paid, so you can take legal ownership of the property.

Cooling off period

If you didn’t buy your property at auction, you may have a cooling off period when you can cancel the contract, although there may be a small penalty. Cooling off periods vary from state to state so check with your relevant state authority in terms of what your rights may be.

To organise your pre-approval and work out how much you can borrow, simply call (03) 9763 0011 for a FREE Home Loan check or visit our contact us page, complete the enquiry form and we will contact you.

Debt Consolidation

Debt consolidation is the process of combining all of your debts into one easy to manage loan and repayment. Many people choose to use their home loan for debt consolidation because it offers a very low interest rate.

Do you have multiple credit card and/or personal loan debts in addition to your home loan? Paying high interest rates with multiple repayments making it hard to keep in front? Maybe you should consider debt consolidation.

Dollar Wise Financial Services can help you reduce your debt and feel more at ease by:

- Looking at your personal debt situation to understand what’s important to you

- Help you consolidate and reduce your debt, which may make it possible to pay off your home, other loans or credit cards sooner

- Help reduce the cost of your debt so you can spend money on things you want

- Help you simplify your debt to create more certainty for your monthly expenses

- Take the stress out of managing your loans by reducing the number of loans you have

- Create a debt reduction plan which may help you to start saving for something important to you.

To organise your debt relief strategy, simply call (03) 9763 0011 for a FREE Home Loan check or visit our contact us page, complete the enquiry form and we will contact you.

Investment Property Loans

For many, once the family home is paid off - or a reasonable amount of it - they start to look at other ways of building wealth. Often their first thought is an investment property.

Purchasing an investment property is usually easier than you think, as long as you are aware of how much equity you have in your home, your comfort level with repayments and what type of investment property you want.

Dollar Wise Financial Services can help work this out for you and then set up your loan to purchase the investment property.

To organise your pre-approval and work out how much you can borrow for an investment property, simply call (03) 9763 0011 for a FREE Home Loan check or visit our contact us page, complete the enquiry form and we will contact you.

Self-Managed Superannuation Fund (SMSF) Borrowing

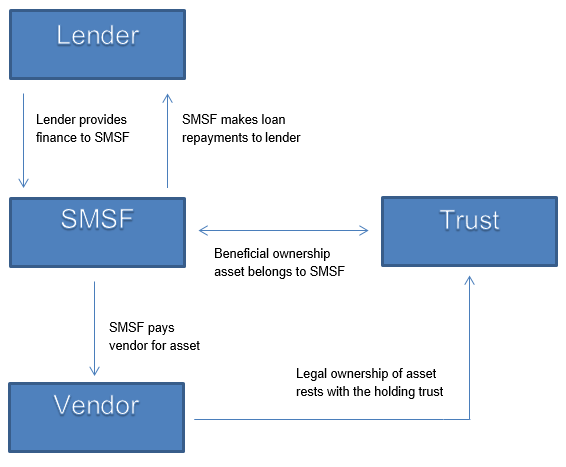

Borrowing money in your superannuation fund for investment purposes is known as ‘Limited Recourse Borrowing Arrangements’ (LRBA’s).

These borrowing arrangements can only be used to purchase a single acquirable asset, for example an investment property.

Dollar Wise Financial Services can help you choose the right lender and find out if your SMSF is capable of setting up a Limited Recourse Borrowing Arrangement to purchase an investment property. These arrangements can be complex in nature with many rules and regulations around borrowing money inside super. They require advice from an Accredited Financial Planner and tax accountant.

Here is an example of the operation of a Limited Recourse Borrowing Arrangement:

For more information on borrowing money in your SMSF or to use our mortgage broking service to set up a Limited Recourse Borrowing Arrangement, please contact us.

Vehicle Leasing & Equipment Finance

To run your business efficiently and compete in today’s fast-paced market, you need the latest business technology, plant equipment or car fleet. But the true benefit to your business comes from the way you use these assets – not where they sit on your balance sheet.

Leasing frees up your working capital, and sometimes provides tax advantages. It allows you to upgrade your technology quickly, without the risk of obsolescence.

Dollar Wise Financial Services can provide a complete financing solution for all different types of business assets. From cars and earthmoving equipment, factory machinery to office furniture and laptops. Everything you need to keep it all running smoothly, without using all your capital to finance it.

For more information on leasing, please contact us.